Introduction

In the ever-evolving landscape of digital payments, businesses are constantly seeking reliable, efficient, and secure payment solutions to streamline their transactions. One such solution that has garnered significant attention in recent years is Razorpay. Founded in 2014 by Harshil Mathur and Shashank Kumar, Razorpay has rapidly emerged as a leading payment gateway in India.

This Razorpay review article delves deep into the various aspects of Razorpay, exploring its features, benefits, pricing, security measures, and much more to provide a thorough understanding of why it stands out in the crowded market of payment gateways.

Background and Overview

Razorpay, headquartered in Bangalore, India, was established with the vision of simplifying the process of accepting, processing, and disbursing payments for businesses. Over the years, Razorpay has expanded its offerings beyond a mere payment gateway, evolving into a comprehensive financial technology platform. It caters to a diverse range of businesses, from small startups to large enterprises, providing them with the tools they need to manage their financial transactions seamlessly.

Key Features of Razorpay

1. Multiple Payment Modes

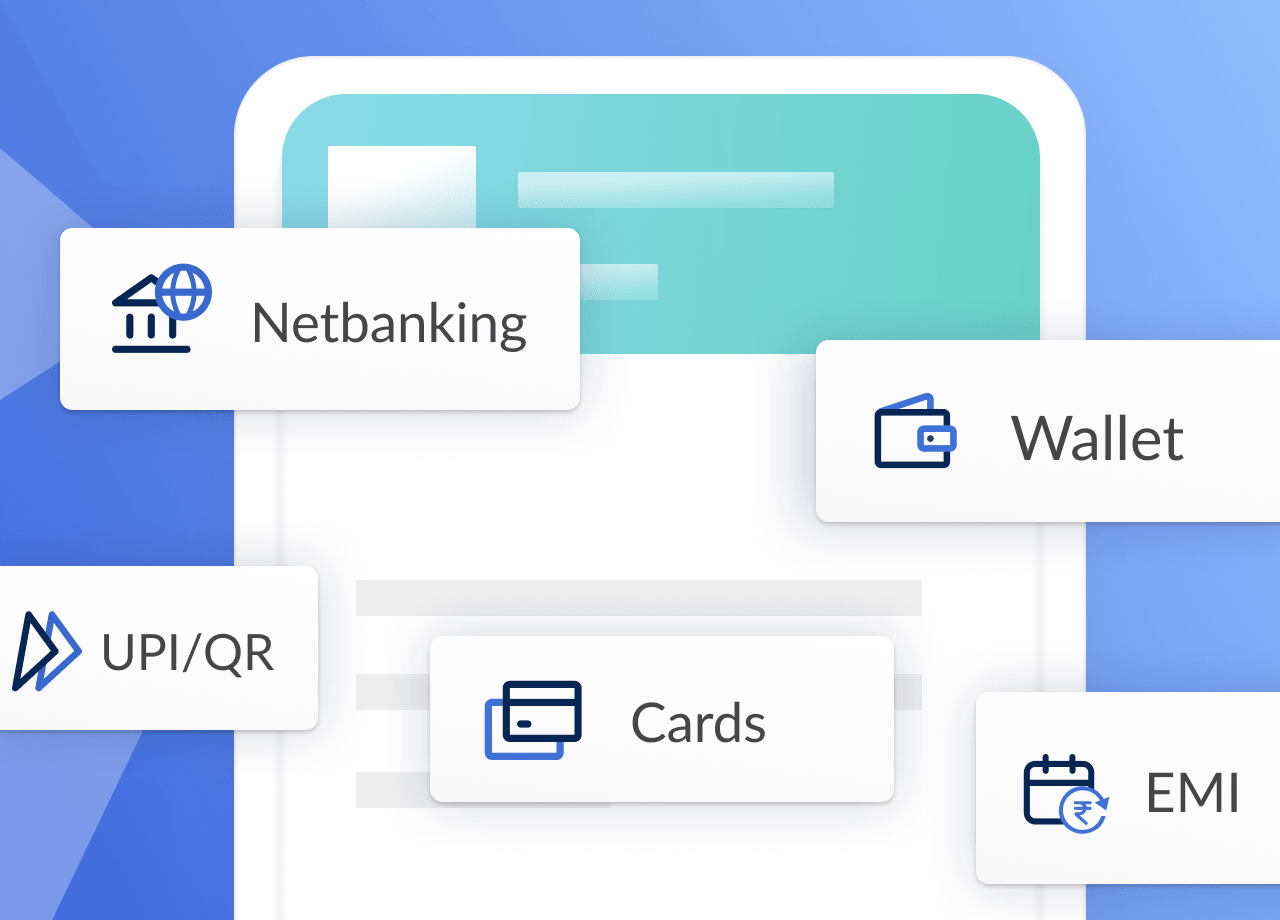

One of the standout features of Razorpay is its ability to support a wide array of payment modes. This includes:

Credit and Debit Cards: Razorpay supports all major credit and debit cards, ensuring that businesses can accept payments from customers using Visa, MasterCard, American Express, and more.

Net Banking: It integrates with over 50 banks, allowing customers to pay directly from their bank accounts.

UPI (Unified Payments Interface): Razorpay’s integration with UPI enables instant payments through apps like Google Pay, PhonePe, and others.

Wallets: It supports popular digital wallets such as Paytm, Mobikwik, Freecharge, and more.

EMI Options: Customers can choose to pay in installments through EMI options provided by various banks.

International Payments: Businesses can accept payments in multiple currencies, making Razorpay a global payment solution.

Cash on Delivery: Razorpay offers a seamless cash-on-delivery service, integrating offline payments into their digital system.

2. Recurring Payments

Razorpay provides robust support for recurring payments, which is essential for businesses offering subscription-based services. This feature automates the billing process, allowing businesses to set up automatic debit schedules for their customers. It supports both fixed and variable billing cycles, ensuring flexibility in payment plans.

3. Instant Settlements

One of the pain points for businesses is the delay in payment settlements. Razorpay addresses this by offering instant settlements, which significantly improves cash flow for businesses. This feature ensures that funds are transferred to the business’s bank account within minutes of the transaction, providing immediate access to working capital.

4. Smart Collect

Razorpay’s Smart Collect feature enables businesses to create and manage virtual accounts for their customers. This allows businesses to automate the process of reconciling incoming payments, making it easier to track and manage multiple transactions. It supports both UPI and NEFT/RTGS/IMPS payment methods.

5. Razorpay Route

Razorpay Route is a powerful tool for businesses that need to split payments between multiple parties. This feature is particularly useful for marketplaces and platforms that need to distribute funds to different vendors or service providers. Razorpay Route ensures that payments are split automatically based on predefined rules, reducing the manual effort involved in payment distribution.

6. Custom Checkout

Razorpay offers a customizable checkout experience, allowing businesses to tailor the payment process to match their branding and user experience. The checkout form can be embedded directly on the website or mobile app, ensuring a seamless and consistent experience for customers.

7. Advanced Dashboard and Analytics

Razorpay provides an intuitive and feature-rich dashboard that offers detailed insights into payment data. Businesses can track transactions, monitor performance, and generate comprehensive reports. The analytics tools help in identifying trends, understanding customer behavior, and making informed business decisions.

Benefits of Using Razorpay

1. Ease of Integration

Razorpay offers simple and straightforward integration options, making it easy for businesses to set up and start accepting payments quickly. It provides a variety of SDKs and plugins for popular platforms such as WordPress, Magento, Shopify, and more. Additionally, it offers detailed documentation and developer support to ensure a smooth integration process.

2. Security

Security is a critical concern when it comes to online payments. Razorpay is PCI DSS Level 1 compliant, which is the highest level of security certification in the payment industry. It employs advanced encryption standards and security protocols to ensure that all transactions are secure. Razorpay also offers features like tokenization and fraud detection to further enhance the security of payments.

3. Customer Support

Razorpay is known for its excellent customer support. It provides 24/7 support through various channels, including email, chat, and phone. Additionally, Razorpay offers a comprehensive knowledge base with detailed articles, guides, and FAQs to help businesses troubleshoot common issues.

4. Scalability

Razorpay is designed to scale with businesses as they grow. Whether you are a small startup or a large enterprise, Razorpay can handle a high volume of transactions efficiently. Its infrastructure is built to support millions of transactions per day, ensuring that your business can scale without any payment processing issues.

5. Competitive Pricing

Razorpay offers competitive pricing with transparent fees. It charges a flat fee per transaction, with no hidden costs. The pricing structure is designed to be affordable for businesses of all sizes, making it a cost-effective solution for payment processing.

Pricing Structure

Razorpay’s pricing is straightforward and transparent. The standard charges are as follows:

- Domestic Credit/Debit Cards, Net Banking, UPI: 2% per transaction

- International Cards: 3% per transaction

- Wallets: 2% per transaction

Razorpay also offers custom pricing plans for businesses with high transaction volumes or specific requirements. Additionally, there are no setup fees or maintenance charges, making it an attractive option for businesses looking to minimize their payment processing costs.

Security Measures

Security is a paramount concern for any payment gateway, and Razorpay goes above and beyond to ensure the safety of its users’ transactions. Here are some of the key security features:

1. PCI DSS Compliance

Razorpay is PCI DSS Level 1 compliant, which means it adheres to the highest security standards in the payment industry. This compliance ensures that sensitive card information is handled in a secure environment, reducing the risk of data breaches.

2. Data Encryption

Razorpay uses advanced encryption methods to protect transaction data. This ensures that all data transmitted between the customer, the business, and Razorpay is encrypted and secure from potential threats.

3. Tokenization

To further enhance security, Razorpay employs tokenization, which replaces sensitive card information with a unique identifier or token. This token can be used for future transactions without exposing the actual card details, reducing the risk of data theft.

4. Fraud Detection

Razorpay uses sophisticated fraud detection algorithms to monitor transactions for suspicious activity. It employs machine learning models to identify and block potentially fraudulent transactions, protecting businesses and customers from fraud.

User Experience

The user experience is a critical aspect of any payment gateway, and Razorpay excels in this area. Here are some of the factors that contribute to its excellent user experience:

1. Intuitive Interface

Razorpay’s dashboard is designed to be user-friendly and intuitive. Businesses can easily navigate through the various features, track transactions, and access detailed reports. The interface is clean and well-organized, making it easy to find the information you need.

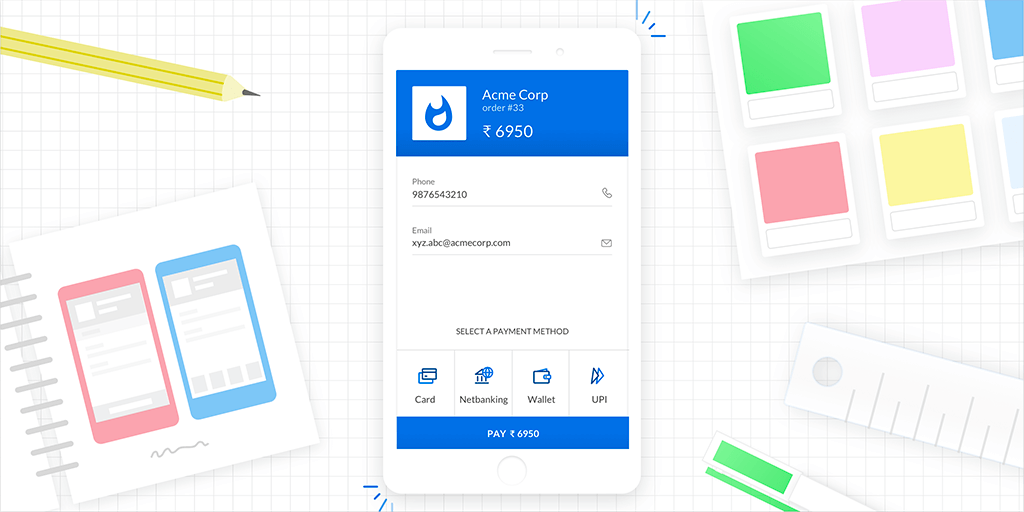

2. Seamless Checkout

The checkout process is smooth and seamless, ensuring a positive experience for customers. The customizable checkout form can be embedded directly on the website or mobile app, providing a consistent and branded experience. The form is optimized for both desktop and mobile devices, ensuring that customers can make payments easily regardless of the device they are using.

3. Quick Onboarding

Razorpay offers a quick and hassle-free onboarding process. Businesses can sign up and start accepting payments within minutes. The integration process is straightforward, with detailed documentation and developer support available to assist with any issues.

Case Studies and Testimonials

Many businesses across various industries have successfully implemented Razorpay to streamline their payment processes. Here are a few examples:

1. UrbanClap

UrbanClap, a leading service marketplace in India, uses Razorpay to manage its payment processes. By integrating Razorpay, UrbanClap was able to offer multiple payment options to its customers, resulting in a significant increase in successful transactions. The seamless checkout experience provided by Razorpay also contributed to a higher customer satisfaction rate.

2. BookMyShow

BookMyShow, a popular online ticketing platform, partnered with Razorpay to enhance its payment processing capabilities. With Razorpay’s support for multiple payment modes and instant settlements, BookMyShow was able to offer a better payment experience to its users. The advanced security features provided by Razorpay also helped in reducing the risk of fraudulent transactions.

3. Zoomcar

Zoomcar, a leading car rental platform, integrated Razorpay to streamline its payment operations. The customizable checkout form and the ability to accept payments from various modes allowed Zoomcar to provide a seamless payment experience to its customers. Razorpay’s instant settlement feature also improved Zoomcar’s cash flow, enabling them to manage their finances more efficiently.

Pros and Cons

Pros

Wide Range of Payment Options: Razorpay supports multiple payment modes, including credit/debit cards, net banking, UPI, wallets, and more.

Easy Integration: The integration process is simple and well-documented, making it easy for businesses to get started quickly.

Security: Razorpay is PCI DSS Level 1 compliant and employs advanced encryption and fraud detection measures.

Recurring Payments: The ability to set up recurring payments is beneficial for subscription-based businesses.

Customizable Checkout: Businesses can tailor the checkout experience to match their branding.

Excellent Customer Support: Razorpay offers 24/7 support through various channels.

Cons

Transaction Fees: While competitive, the transaction fees can add up for businesses with high transaction volumes.

Limited International Support: Razorpay primarily focuses on the Indian market, which may be a limitation for businesses with a global presence.

Occasional Technical Issues: Some users have reported occasional technical issues, although Razorpay’s support team is prompt in resolving them.

Conclusion

Razorpay has established itself as a robust and reliable payment gateway, offering a wide range of features and benefits that cater to the needs of businesses of all sizes. Its support for multiple payment modes, ease of integration, advanced security measures, and excellent customer support make it a top choice for businesses looking to streamline their payment processes.

While there are some areas for improvement, such as the transaction fees and occasional technical issues, Razorpay’s overall value proposition is compelling. The platform’s commitment to security and innovation, combined with its user-friendly interface and comprehensive feature set, ensures that businesses can manage their payments efficiently and securely.

For businesses operating primarily in India, Razorpay provides an unparalleled payment processing experience. Its ability to handle a variety of payment methods, support for recurring payments, and advanced analytics capabilities make it a versatile solution that can adapt to the evolving needs of any business. Moreover, its competitive pricing and excellent customer support further enhance its appeal.

In summary, Razorpay is a powerful and reliable payment gateway that offers a comprehensive solution for businesses looking to enhance their payment processing capabilities. Its extensive feature set, combined with its commitment to security and customer satisfaction, makes it a top contender in the payment gateway market. Whether you are a small startup or a large enterprise, Razorpay provides the tools and support you need to manage your payments effectively and grow your business.

If you enjoyed this article, then you’ll love Zalvis's WordPress Hosting platform. Turbocharge your website and get 24/7 support from our veteran team. Our world-class hosting infrastructure focuses on auto-scaling, performance, and security. Let us show you the Zalvis difference! Check out our plans.